The changing face of finance

Asset finance was worth a record €35.7 billion in 2019, according to the Finance & Leasing Association (FLA). The figure underlines the growth of alternative funding after the financial crisis of 2007/8, when banks were unwilling to lend and the financial services industry underwent sweeping regulatory and technology changes.

New routes for asset finance have developed on the strength of digital technology and fintech innovations, while the introduction of open banking in 2018 marked an industry turning point. With open banking, all bank data is available with the owner’s consent. It means banks can share data electronically with third parties through open APIs once owners have granted permission, enabling alternative finance providers to create new products and services. There is no need for photocopies, scanning and losable paper trails.

Customer focus

In combination, open banking and new technologies such as data analytics and artificial intelligence enable asset finance companies to provide a far more customer-focused and tailored service. Today, across all industries, customer focus is a must. Consumers expect digitally-enabled services that precisely match their needs and are delivered when and how they want.

Digital acceleration

While new technology has already done much to change financial services, Covid- 19 has accelerated the growth of digital business and increased the need to automate. Although the pandemic may have temporarily dented the demand for asset finance, with the AFL reporting in November 2020 that new business was 25% down on 2019, asset finance companies must be digitally enabled to succeed in a world that has been further changed by Covid- 19.

As remote working increases, successful collaboration will depend on the availability, timeliness and relevance of information. Digital connectivity in today’s open environment allows for the free flow of electronic data, rather than paper-based formats, enriching and simplifying underwriting. This leads to speedier and more informed decision-making, greater consistency, and a better experience for customers.

Beyond lending

Furthermore, technology is adding value to the lending process. Digital platforms and tools can identify service pain points’, helping finance providers get closer to their customers, and highlight opportunities to create new value. Lenders can draw on third-party services to meet customer needs and widen their core offering, a development which may see lenders become far more than pure asset financiers.

Managing risk

Although open banking and technology are creating business opportunities, they also pose risks through identity fraud, which is becoming increasingly sophisticated. Sharing information between funders is very important so that different funders can see if they’ve had the same proposal as you — and therefore spot fraud.

Cifas, the UK’s leading fraud prevention service, reported an 18% increase in identity fraud in 2019 compared to the previous year — the highest yearly increase ever recorded on its fraud database. Gains in speed and service quality must always be backed by the highest levels of security. One promising development is the use of digital IDs, as discussed in the next section.

Technology framework and benefits

What does a post-Covid finance platform look like?

For many asset finance providers, lending still involves time-consuming and unnecessary manual processes; but when the latest technology is integrated into workflows, the result is greater efficiency and less fraud. Here are some of the technologies and practices that will help to automate and scale your business.

Software delivered as a Service

Having reliable and meaningful data is the foundation for successful customer relationships. Using cloud computing, customer information is centralised and can be swiftly and easily shared between finance teams. When the cloud supports a Software-as- a-Service (Saas) delivery model, customers have a living, breathing platform that is flexible, scalable and constantly updated. That’s why SaaS is increasingly used by asset finance technology providers such as QV Systems.

The SaaS model supports on-demand services that run on the provider’s servers and are accessed via the internet. This enables end users to focus on delivering great service to their customers and growing their businesses without having to manage an unwieldy IT infrastructure. Another key benefit is the ability to integrate artificial intelligence and other advanced technologies, which increases speed and overall customer service.

Digital pricing and calculation

Powerful pricing and calculation tools can be integrated into the sales process, and lenders can use the data submitted by a customer to find the best deal based on the customer’s circumstances and needs, thus increasing customer focus and satisfaction. If you have a pricing and calculation engine that feeds into your platform, there is no need to rekey information; you can streamline your calculation process with a single source of truth for your whole business; and you can centralise control with full visibility over the contract lifecycle, from onboarding to termination.

Online proposals and documents management

When the best deal has been found, you will need to share and track it between customers and funders. Proposal management tools centralise proposals so you can track them as well as live deals in real time. This avoids time wasted on paperwork and manual sharing. With the increase in remote working, all team members can see the same proposal (subject to permission) and work with the same shared and correct information.

Electronic Identity Verification (elDV)

elDV uses publicly available data as well as private databases to quickly verify a person’s identity. It complies with know-your-customer requirements, anti-money laundering laws, data privacy and other regulations. Where asset finance professionals once relied on time-consuming manual processing, they now have an instant, easily accessible and dependable electronic audit trail. No more photocopying documents, storing hard copies or distributing documents to everyone in the financing chain.

E-signature and closing

Once a customer has accepted a proposal, you can close the deal by using an e-signature to instantly sign paperwork online. Deals can be closed with clients anywhere, and you have more accountability and traceability for your customers and funders.

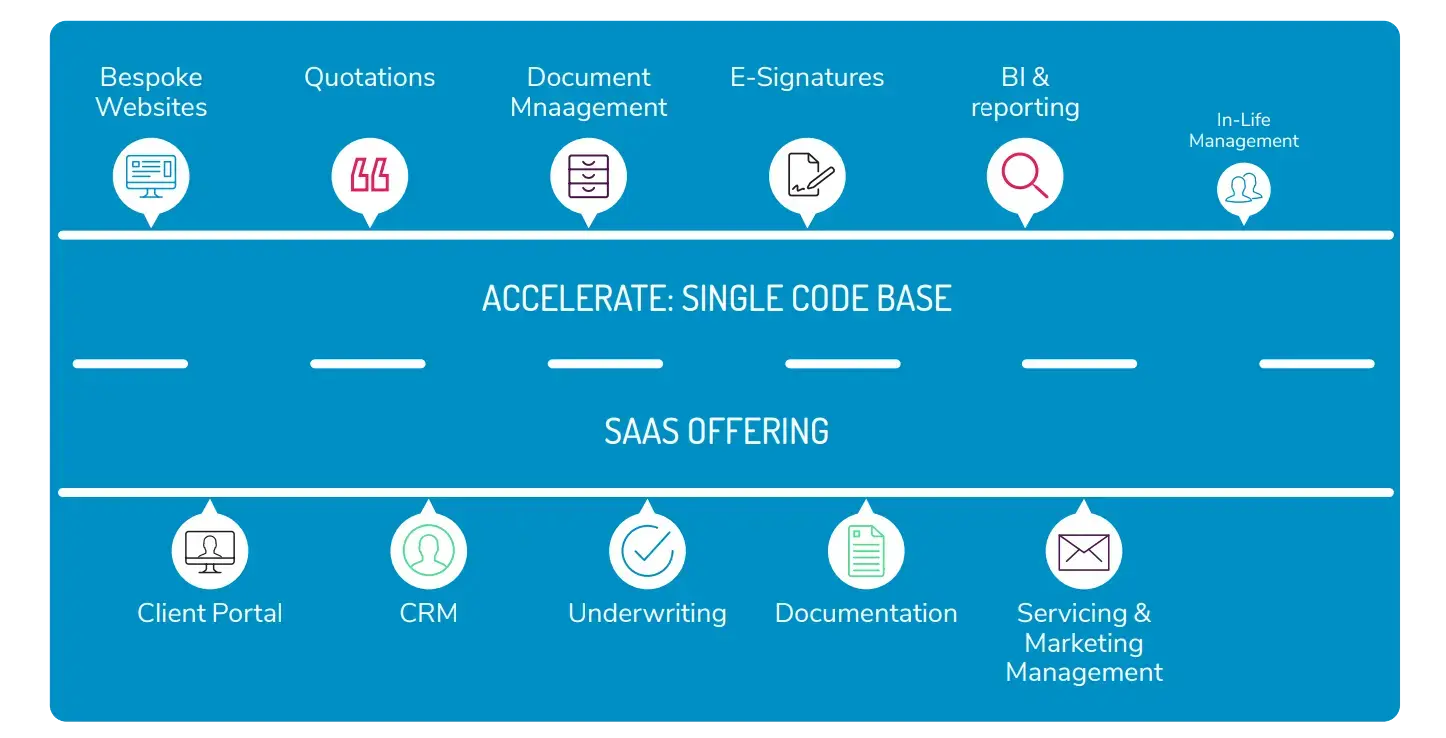

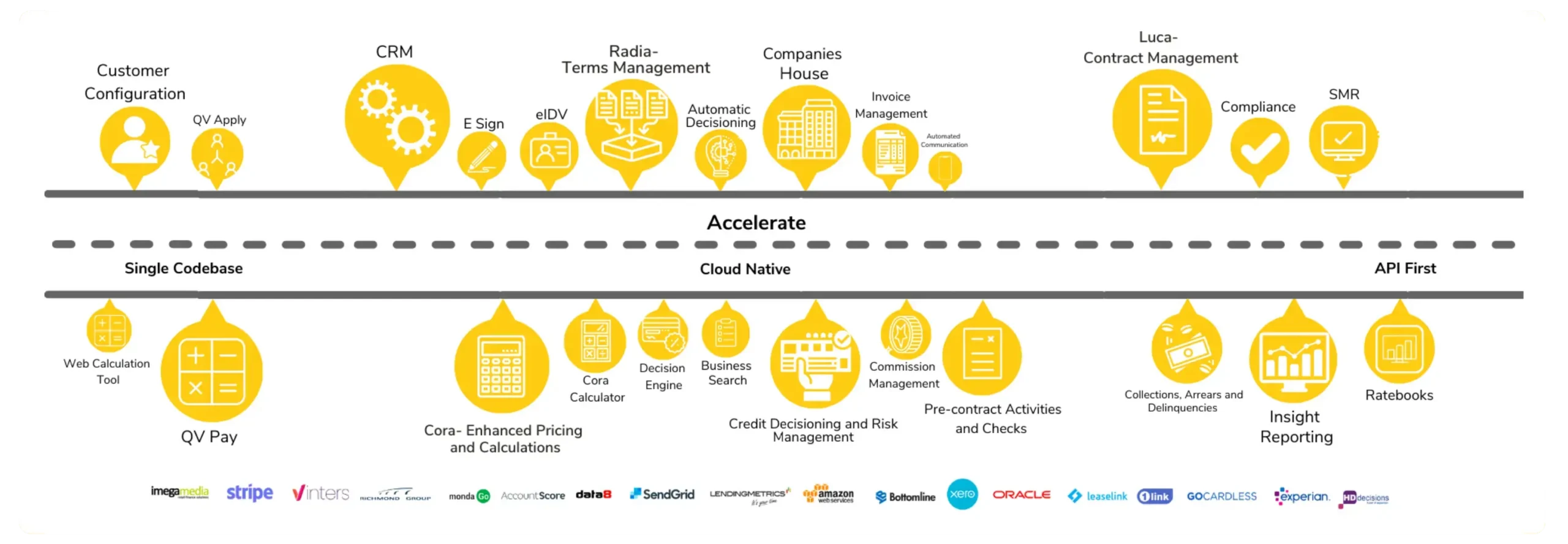

QV Systems: profile and applications

Accelerate, QV Systems’ advanced platform for asset finance, combines all the benefits of open banking with the latest cloud solutions and digital tools, allowing you to choose the functionality you need to enhance your business. It’s a versatile SaaS platform that offers a seamless end-to-end customer experience.

Key benefits of QV’S Asset Finance Platform

- Improved end-to-end efficiency: Streamline your workflows and close deals faster with instant quotes, digital proposals and easy automation.

- Engage and retain customers: Enhance your customer experience with centralised deal tracking, efficient communication and instant connections.

- Build long-term agility: Digitisation is driving rapid change in the market. Stay ahead with a platform that adapts to your needs and evolves with your business.

Open and streamlined

QV Systems is integrating open banking into workflows so businesses can operate effectively in the open environment. This not only provides customers with a market leading customer experience, but allows businesses to make better decisions based on data.

With balance sheet lending now used less and less, integrations with open banking and open accounting providers are essential for effective lending. Through QV Systems’ partnership with AccountScore, the UK’s leading open banking data and analytics provider for financial services, brokers can provide critical data to funders so they can underwrite and analyse deals without having to receive and scan personal information such as bank records.

With QV Systems, all the accounting information you need is up-to-date and complete. There are no bank statements to collate and store: everything is consolidated and simplified for speed, accuracy, consistency.

Powerful integrations

With Accelerate, asset finance firms can choose the tools and skills that suit their business, as it integrates with systems from technology suppliers, consultancies and other third-parties. A growing number of other integrations and partnerships, such as with Experian, Xero, Go Cardless and cap hpi, are continually adding value to the Accelerate platform.

Electronic security

Electronic Identify Verification is used to verify driving licences and directors’ identities, among other electronic ID checks. This complements open banking and accounting, helping QV Systems’ customers deliver the sophisticated technology and seamless customer experience that end users expect today.

Take your business into the future

Asset finance companies can transform their businesses by embracing the power of open banking and digitalisation. As open banking matures and firms compete in a post-Covid world, the winners will be the ones who use technology to enhance customer journeys while adding value to the lending experience and strengthening security.

Find out how QV Systems’ platform and bespoke technology can improve your asset finance business. Visit the QV Systems website to build your own Accelerate, by choosing the products you need to enhance your business. Find out how QV Systems’ Accelerate Platform can future-proof your business, by speaking with our experts today.